Introduction

This page describes the Saferpay JSON application programming interface.

Our API is designed to have predictable, resource-oriented URLs and to use HTTP response codes to indicate API errors. We use built-in HTTP features, like HTTP authentication and HTTP verbs, which can be understood by off-the-shelf HTTP clients. JSON will be returned in all responses from the API, including errors.

Content Encoding

UTF-8 must be used for text encoding (there are restrictions on allowed characters for specific fields though).

Content-Type and Accept headers should be set to application/json for server-to-server calls. Redirects use the standard browser types.

HTTP Headers:

Content-Type: application/json; charset=utf-8

Accept: application/json

Formats

The Saferpay JSON Api uses unified and standardized formats. The following abbreviations for format information are used in this page:

| Name | Definition | Description |

|---|---|---|

| Id | A-Za-z0-9.:-_ | Alphanumeric with dot, colon, hyphen and underscore. |

| Numeric | 0-9 | Numbers. |

| Boolean | true or false | Boolean values. |

| Date | ISO 8601 Date and Time | ISO 8601 format, e.g. 2007-12-24T18:21:25.123Z (UTC) or 2007-12-24T19:21:25.123+01:00 (CET). Max 3 digits in the fractional seconds part. |

Authentication

Saferpay supports the mechanism of basic authentication or a client certificate for authentication of a server (host) system.

Important: You must use either the Basic Authentication, OR the Client Certificate, but not both! Also make sure, that you do not send any faulty or old certificates, or authentication/accept headers. Otherwise our corporate Firewall will reject the call with a 403-Forbidden status! Furthermore, please note, that some environments do this by default. So even if you didn't implement it, the environment may do it as a default! It may be necessary to check your configuration.

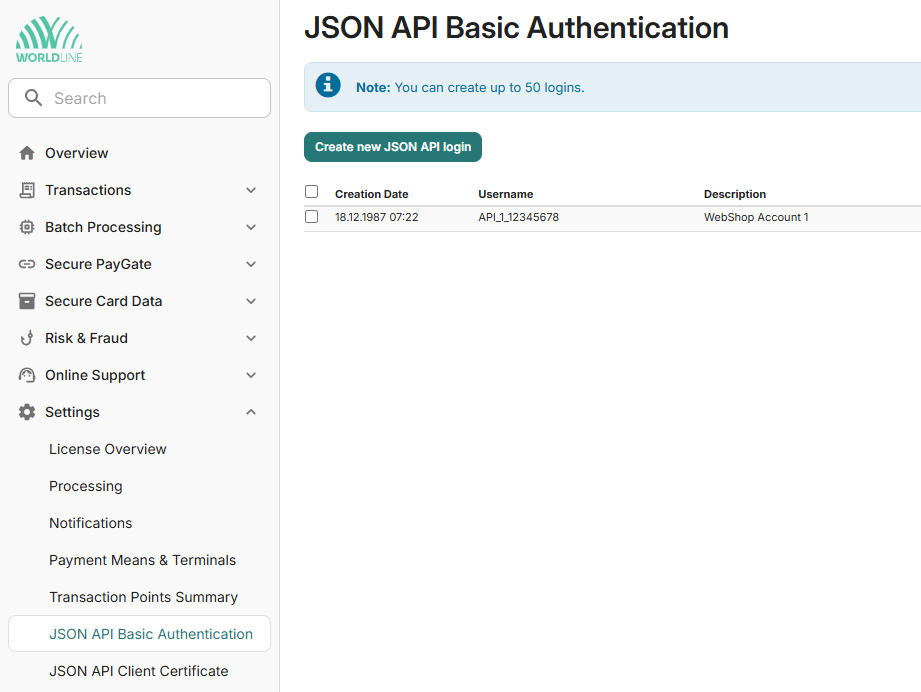

HTTP basic authentication

This is the default authentication method. Technical users for the JSON API can be created by the merchant in the Saferpay Backoffice under Settings > JSON API basic authentication. The password will not be stored at SIX (only a securely salted hash thereof). There will be no password recovery besides creating a new user / password pair from your Backoffice account.

The password must meet some complexity requirements. We suggest using / generating dedicated passwords with a length of 16 alphanumeric characters (up to 32 characters).

HTTP Header:

Authorization: Basic [your base64 encoded "user_name:password"]

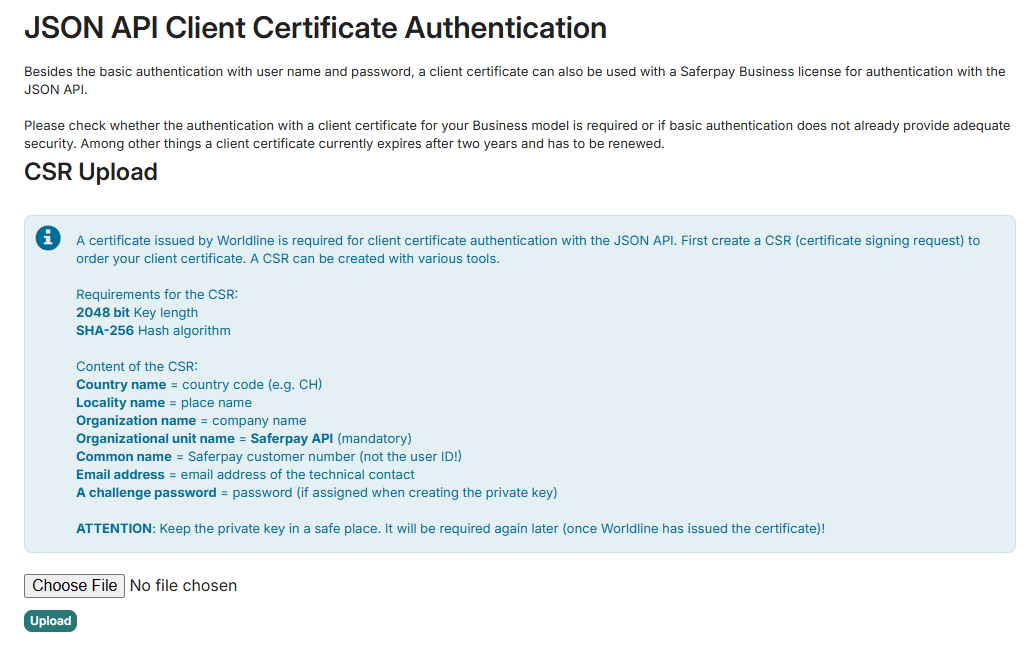

HTTPS Client Certificate Authentication

Alternatively, Saferpay also supports authentication via a client certificate.

Important: This feature is only available for Saferpay Business merchants!

A client certificate for the JSON-API can be ordered in the Saferpay Backoffice under Settings > JSON API client certificate.

If you have a Saferpay Business licence, you will find the HTTPS Client Certificate Authentication section under the form for HTTPS Basic Authentication.

Generate the CSR as described on the page and import it using the upload button. The signed client certificate will then be downloaded through your browser.

Integration

Test Environment

For the integration phase, you should visit our test environment! There you can register your personal test account, which you then can use for testing, to try out different functions and for general evaluation.

You can find a list of test-cards and other payment means for testing over here!

Integration Guide

While these Documents are meant as a quick reference and technical specification of the Saferpay JSON-API, the Saferpay Integration Guide contains an in depth explanation about payment-flows, tips and tricks, as well as best practices for those, who want to integrate the JSON-API and its features for the first time. It will also help to understand certain characteristics about the different payment methods we offer, as well as the rules you must follow, when processing vital credit card data and more.

The sequential steps of the general integration process are described in our Step-by-step Integration-Manual.

Server-to-Server code Samples

The JSON API is a modern and lightweight interface, that can be used with all shop systems and all programming languages. Only a few steps are necessary to integrate your online shop with Saferpay. The proceeding is mostly as follows:

- Initialize via secure server-to-server call

- Integrate iframe to redirect your customer

- Authorize/ assert customer interaction via secure server-to-server call

In secure server-to-server calls you have to submit a JSON request containing you processing instructions to the defined URLs. The URL and the JSON structure varies depending on the action/resource you want to call. For further details check the description of resources below.

Server-to-server calls are a secure way to submit and gather data. Hence, a server-to-server call should always follow after the customer returns back to the shop, to gather information about the outcome of e.g. 3D Secure.

Important: Saferpay only supports TLS 1.2 and up, for secure connections. Please make sure, that your system is configured accordingly! More information in our TLS-FAQ.

Important: The redirect towards the redirectUrl via http-POST IS NOT supported. You should always use http-GET, unless specifically stated otherwise!

Caution: Please DO NOT use client side scripting languages like JavaScript to execute the server-to-server (JSON) calls directly. Clients could manipulate the code, or even try to extract the credentials, to execute refunds or other requests with malicious intentions. Always execute the requests and keep your credentials on your server, maybe by using AJAX.

Caution: DO NOT implement a polling-process, to poll for the transaction-data. Respond with the necessary request, at the correct time (e.g. doing the assert only, if the SuccessUrl, or NotifyUrl are called). Saferpay reserves the right to otherwise deactivate, or block your account!

Server-to-server communication:

private object SubmitRequest(string sfpUrl, object request, string sfpLogin, string sfpPassword)

{

// don't keep your connection alive, it's a simple request/response server call

// for details on NoKeepAliveWebClient, see https://github.com/saferpay/jsonapi/blob/master/snippets/NoKeepAliveWebClient.cs

using (var client = new NoKeepAliveWebClient())

{

string authInfo = $"{sfpLogin}:{sfpPassword}";

client.Headers[HttpRequestHeader.Authorization] = "Basic " + Convert.ToBase64String(Encoding.UTF8.GetBytes(authInfo));

client.Headers[HttpRequestHeader.Accept] = "application/json";

client.Headers[HttpRequestHeader.ContentType] = "application/json; charset=utf-8";

client.Encoding = Encoding.UTF8;

try

{

var responseData = client.UploadString(sfpUrl, JsonConvert.SerializeObject(request));

return JsonConvert.DeserializeObject(responseData);

}

catch (WebException we)

{

if (we.Response is HttpWebResponse response)

{

Trace.WriteLine($"Web exception occured: {response.StatusCode} {response.StatusDescription}");

if (response.ContentLength > 0)

{

using (var rs = we.Response.GetResponseStream())

using (var sr = new StreamReader(rs))

{

Trace.WriteLine($"{sr.ReadToEnd()}");

}

}

}

else

{

Trace.WriteLine($"Web exception occured: {we.Message} ({we.Status}");

}

throw;

}

}

}

public static JsonObject sendRequest(URL sfpUrl, JsonObject request, String sfpLogin, String sfpPassword) throws IOException {

//encode credentials

String credential = sfpLogin + ":" + sfpPassword;

String encodedCredentials = DatatypeConverter.printBase64Binary(credential.getBytes());

//create connection

HttpURLConnection connection = (HttpURLConnection) sfpUrl.openConnection();

connection.setRequestProperty("connection", "close");

connection.setRequestProperty("Content-Type", "application/json; charset=utf-8");

connection.setRequestProperty("Accept", "application/json");

connection.setRequestProperty("Authorization", "Basic " + encodedCredentials);

connection.setRequestMethod("POST");

connection.setDoOutput(true);

connection.setUseCaches(false);

//write JSON to output stream

JsonWriter writer = Json.createWriter(connection.getOutputStream());

writer.writeObject(request);

writer.close();

//send request

int responseCode = connection.getResponseCode();

//get correct input stream

InputStream readerStream = responseCode == 200 ? connection.getInputStream() : connection.getErrorStream();

JsonObject response = Json.createReader(readerStream).readObject();

return response;

}

//This is an EXAMPLE of the payload-Array.

$payload = array(

'RequestHeader' => array(

'SpecVersion' => "[current Spec-Version]",

'CustomerId' => "[YOUR CUSTOMERID]",

'RequestId' => "aScdFewDSRFrfas2wsad3",

'RetryIndicator' => 0,

'ClientInfo' => array(

'ShopInfo' => "My Shop",

'OsInfo' => "Windows Server 2013"

)

),

'TerminalId' => "[YOUR TERMINALID]",

'PaymentMethods' => array("DIRECTDEBIT","VISA"),

'Payment' => array(

'Amount' => array(

'Value' => "21065",

'CurrencyCode' => "EUR"

),

'OrderId' => "123test",

'PayerNote' => "A Note",

'Description' => "Test_Order_123test"

),

'Payer' => array(

'IpAddress' => "192.168.178.1",

'LanguageCode' => "en"

),

'ReturnUrl' => array(

'Url' => "[your shop payment url]"

),

'Notification' => array(

'PayerEmail' => "payee@mail.com",

'MerchantEmails' => array("merchant@mail.com"),

'SuccessNotifyUrl' => "[your success notify url]",

'FailNotifyUrl' => "[your fail notify url]"

),

'DeliveryAddressForm' => array(

'Display' => true,

'MandatoryFields' => array("CITY","COMPANY","COUNTRY","EMAIL","FIRSTNAME","LASTNAME","PHONE","SALUTATION","STATE","STREET","ZIP")

)

);

//$username and $password for the http-Basic Authentication

//$url is the SaferpayURL eg. https://www.saferpay.com/api/Payment/v1/PaymentPage/Initialize

//$payload is a multidimensional array, that assembles the JSON structure. Example see above

function do_curl($username,$password,$url, $payload){

//Set Options for CURL

$curl = curl_init($url);

curl_setopt($curl, CURLOPT_HEADER, false);

//Return Response to Application

curl_setopt($curl, CURLOPT_RETURNTRANSFER, true);

//Set Content-Headers to JSON

curl_setopt($curl, CURLOPT_HTTPHEADER,array("Content-type: application/json","Accept: application/json; charset=utf-8"));

//Execute call via http-POST

curl_setopt($curl, CURLOPT_POST, true);

//Set POST-Body

//convert DATA-Array into a JSON-Object

curl_setopt($curl, CURLOPT_POSTFIELDS, json_encode($payload));

//WARNING!!!!!

//This option should NOT be "false", otherwise the connection is not secured

//You can turn it of if you're working on the test-system with no vital data

//PLEASE NOTE:

//Under Windows (using WAMP or XAMP) it is necessary to manually download and save the necessary SSL-Root certificates!

//To do so, please visit: http://curl.haxx.se/docs/caextract.html and Download the .pem-file

//Then save it to a folder where PHP has write privileges (e.g. the WAMP/XAMP-Folder itself)

//and then put the following line into your php.ini:

//curl.cainfo=c:\path\to\file\cacert.pem

curl_setopt($curl, CURLOPT_SSL_VERIFYPEER, true);

curl_setopt($curl, CURLOPT_SSL_VERIFYHOST, 2);

//HTTP-Basic Authentication for the Saferpay JSON-API.

//This will set the authentication header and encode the password & username in Base64 for you

curl_setopt($curl, CURLOPT_USERPWD, $username . ":" . $password);

//CURL-Execute & catch response

$jsonResponse = curl_exec($curl);

//Get HTTP-Status

//Abort if Status != 200

$status = curl_getinfo($curl, CURLINFO_HTTP_CODE);

if ($status != 200) {

//IF ERROR

//Get http-Body (if aplicable) from CURL-response

$body = json_decode(curl_multi_getcontent($curl), true);

//Build array, containing the body (Response data, like Error-messages etc.) and the http-status-code

$response = array(

"status" => $status . " <|> " . curl_error($curl),

"body" => $body

);

} else {

//IF OK

//Convert response into an Array

$body = json_decode($jsonResponse, true);

//Build array, containing the body (Response-data) and the http-status-code

$response = array(

"status" => $status,

"body" => $body

);

}

//IMPORTANT!!!

//Close connection!

curl_close($curl);

//$response, again, is a multi-dimensional Array, containing the status-code ($response["status"]) and the API-response (if available) itself ($response["body"])

return $response;

}

If you include the redirect pages into your web-page using an iframe, you can react on size changes of the iframe content by listening to a message event containing the new sizing information.

Please note: Depending on the bank, issuer, or payment provider, the page can try to break out of the iframe or lack telling you the actual size of the content.

Handle JavaScript events from Saferpay (for JQuery 1.9 and higher):

$(window).bind('message', function (e) {

switch (e.originalEvent.data.message) {

case 'css':

$('#iframe').css('height', e.originalEvent.data.height + "px");

break;

}

});

Granting IP-permission

As an additional security feature, you can also grant permissions to specific IPs. This way you can control the API access even further in connection with the authentication credentials. To do so, you need to log into the Saferpay Backoffice, for either production or test, then go under Settings > IP permissions and enter the IP, or IP range of your network/server!

Note: This feature is entirely optional and only supports IPv4 addresses only!

Building the correct API URL

Every request is differentiated by its own unique request URL. This way Saferpay knows which API-function you want to access. Combined with the base URL for either the production- or test-environment, you will get the complete API-URL. Here is an example of how to build this URL correctly:

Base URL production system:

https://www.saferpay.com/api

Base URL test system:

https://test.saferpay.com/api

Take the correct request URL and add it to the base URL. You can find it on the right side of the request-specification.

For instance, if you want to call PaymentPage Initialize, the request URL is:

/Payment/v1/PaymentPage/Initialize

Add this to the base URL and you will get the full API URL:

Full API URL production system:

https://www.saferpay.com/api/Payment/v1/PaymentPage/Initialize

Full API URL test system:

https://test.saferpay.com/api/Payment/v1/PaymentPage/Initialize

Error Handling

Successfully completed requests are confirmed with an http status code of 200 and

contain the appropriate response message in the body.

If the request could not be completed successfully, this is indicated by a status code

of 400 or higher and – if possible (some errors are generated by the web server itself,

or the web application firewall and are thus outside of our control) – an error message

stating the reason of the failure is included in the body of the response. The presence

of an error message as specified in this document can be derived from the content type:

if it’s application/json, then there is an error message present.

HTTP status codes:

| 200 | OK (No error) |

| 400 | Validation error |

| 401 | Authentication of the request failed |

| 402 | Requested action failed |

| 403 | Access denied |

| 406 | Not acceptable (wrong accept header) |

| 415 | Unsupported media type (wrong content-type header) |

| 500 | Internal error |

Info: The API timeout for requests should be 100 seconds! After that, a connection should be closed. Also, no further actions should be taken, until the request is answered or runs into a timeout, to prevent unwanted behavior.

Error Message

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Risk object |

Contains additional risk related information for the transaction that is blocked by risk.

|

|

Behavior mandatory, string |

What can be done to resolve the error?

Possible values: DO_NOT_RETRY, OTHER_MEANS, RETRY, RETRY_LATER. |

|

ErrorName mandatory, string |

Name / id of the error. These names will not change, so you may parse these and attach your logic to the ErrorName.

|

|

ErrorMessage mandatory, string |

Description of the error. The contents of this element might change without notice, so do not parse it.

|

|

TransactionId string |

Id of the failed transaction, if available

|

|

ErrorDetail array of strings |

More details, if available. Contents may change at any time, so don’t parse it.

|

|

ProcessorName string |

Name of acquirer (if declined by acquirer) or processor

|

|

ProcessorResult string |

Result code returned by acquirer or processor

|

|

ProcessorMessage string |

Message returned by acquirer or processor

|

|

PayerMessage string |

A text message provided by the card issuer detailing the reason for a declined authorization. It is safe to display it to the payer.

|

|

OrderId string |

OrderId of the failed transaction. This is only returned in the PaymentPage Assert Response and the Transaction Authorize Response.

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Behavior": "DO_NOT_RETRY",

"ErrorName": "VALIDATION_FAILED",

"ErrorMessage": "Request validation failed",

"ErrorDetail": [

"PaymentMeans.BankAccount.IBAN: The field IBAN is invalid."

],

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"OrderId": "c52ad18472354511ab2c33b59e796901"

}

List of behaviors:

| DO_NOT_RETRY | Do not try again to avoid potential fees related to authorization reattempts that do not respect card schemes instructions. The card issuer will never approve this authorization request. |

| RETRY | Request is valid and understood, but can't be processed at this time. This request can be retried. |

| RETRY_LATER | This request can be retried later after a certain state/error condition has been changed. For example, insufficient funds (up to 10 attempts in 30 days) |

| OTHER_MEANS | Special case of retry. Please provide another means of payment. |

List of error names (these names will not change, so you may parse these and attach your logic to the ErrorName):

| ACTION_NOT_SUPPORTED | The requested action is not supported in the given context or the action can't be executed with the request data. |

| ALIAS_INVALID |

The alias is not known or already used (in case of registration). Solution: Use another alias for registration |

| AMOUNT_INVALID | The amount does not adhere to the restrictions for this action. E.g. it might be exceeding the allowed capture amount. |

| AUTHENTICATION_FAILED |

Wrong password, wrong client certificate, invalid token, wrong HMAC. Solution: Use proper credentials, fix HMAC calculation, use valid token |

| BLOCKED_BY_RISK_MANAGEMENT |

Action blocked by risk management Solution: Unblock in Saferpay Risk Management (Backoffice) |

| CARD_CHECK_FAILED |

Invalid card number or cvc (this is only returned for the SIX-internal chard check feature for Alias/InsertDirect). Solution: Let the card holder correct the entered data |

| CARD_CVC_INVALID |

Wrong cvc entered Solution: Retry with correct cvc |

| CARD_CVC_REQUIRED |

Cvc not entered but required Solution: Retry with cvc entered |

| COMMUNICATION_FAILED |

The communication to the processor failed. Solution: Try again or use another means of payment |

| COMMUNICATION_TIMEOUT |

Saferpay did not receive a response from the external system in time. It’s possible that an authorization was created, but Saferpay is not able to know this. Solution: Check with the acquirer if there is an authorization which needs to be canceled. |

| CONDITION_NOT_SATISFIED | The condition which was defined in the request could not be satisfied. |

| CURRENCY_INVALID | Currency does not match referenced transaction currency. |

| GENERAL_DECLINED | Transaction declined by unknown reason |

| INTERNAL_ERROR |

Internal error in Saferpay Solution: Try again |

| NO_CONTRACT |

No contract available for the brand / currency combination. Solution: Use another card or change the currency to match an existing contract or have the currency activated for the contract. |

| NO_CREDITS_AVAILABLE |

No more credits available for this account. Solution: Buy more transaction credits |

| PAYER_AUTHENTICATION_REQUIRED | Payer authentication required to proceed (soft decline). |

| PAYMENTMEANS_INVALID | Invalid means of payment (e.g. invalid card) |

| PAYMENTMEANS_NOT_SUPPORTED | Unsupported means of payment (e.g. non SEPA IBAN) |

| PERMISSION_DENIED | No permission (e.g. terminal does not belong to the customer) |

| 3DS_AUTHENTICATION_FAILED |

3D-secure authentication failed – the transaction must be aborted. Solution: Use another card or means of payment |

| TOKEN_EXPIRED |

The token is expired. Solution: Create a new token. |

| TOKEN_INVALID | The token either does not exist for this customer or was already used |

| TRANSACTION_ABORTED | The transaction was aborted by the payer. |

| TRANSACTION_ALREADY_CAPTURED | Transaction already captured. |

| TRANSACTION_DECLINED |

Declined by the processor. Solution: Use another card or check details. |

| TRANSACTION_IN_WRONG_STATE | |

| TRANSACTION_NOT_FOUND | |

| TRANSACTION_NOT_STARTED |

The transaction was not started by the payer. Therefore, no final result for the transaction is available. Solution: Try again later. |

| UNEXPECTED_ERROR_BY_ACQUIRER |

The acquirer returned an unexpected error code. Solution: Try again |

| UPDATE_CARD_INFORMATION |

Card details need to be updated in order to have the possibility of a successful payment Solution: Update card data |

| VALIDATION_FAILED |

Validation failed. Solution: Fix request |

Payment Page

The Payment Page Interface provides a simple and easy integration of Saferpay into your web shop, mobile app or other applications without the need to implement a user interface for card data entry. The Saferpay Payment Page can be used with a Saferpay eCommerce license as well as with a Saferpay Business license. It allows the processing of all payment methods that are available with Saferpay. Once integrated, more payment methods can be activated at any time and without major adjustments.

Payment Process with the Payment Page

This chapter will give you a simple overview about the transaction flow, when using the Payment Page

Important Note: If you have trouble understanding the transaction flow with the Payment Page in its detail, you may want to read our Saferpay Integration guide, which offers an in depth explanation on how to integrate the Payment Page, optional features, best practices and more.

Transaction-flow

- Payment Page Initialize

- Initializes the Payment and generates the RedirectUrl for the Payment Page.

- Redirect to the RedirectUrl

- Return to ReturnUrl. The ReturnUrl is defined in step 1!

- Payment Page Assert

- Gathers all the information about the payment, like LiabilityShift through 3D Secure and more, using the Token, gathered in step 1!

- Depending on the outcome of step 4 you may

- Transaction is finished!

PaymentPage Initialize

POST

This method can be used to start a transaction with the Payment Page which may involve either DCC and / or 3d-secure

Request URL:

POST: /Payment/v1/PaymentPage/Initialize

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

ConfigSet string |

This parameter let you define your payment page config (PPConfig) by name. If this parameters is not set, your default PPConfig will be applied if available.

Id[1..20]When the PPConfig can't be found (e.g. wrong name), the Saferpay basic style will be applied to the payment page. Example: name of your payment page config (case-insensitive)

|

|

TerminalId mandatory, string |

Saferpay terminal id

Numeric[8..8]Example: 12345678

|

|

Payment mandatory, object |

Information about the payment (amount, currency, ...)

|

|

PaymentMethods array of strings |

Used to restrict the means of payment which are available to the payer for this transaction. If only one payment method id is set, the payment selection step will be skipped.

Possible values: ACCOUNTTOACCOUNT, ALIPAY, AMEX, BANCONTACT, BONUS, DINERS, CARD, DIRECTDEBIT, EPRZELEWY, EPS, GIROPAY, IDEAL, INVOICE, JCB, KLARNA, MAESTRO, MASTERCARD, MYONE, PAYCONIQ, PAYDIREKT, PAYPAL, POSTFINANCEPAY, SOFORT, TWINT, UNIONPAY, VISA, WECHATPAY, WLCRYPTOPAYMENTS.Example: ["VISA", "MASTERCARD"]

|

|

PaymentMethodsOptions object |

Optional. May be used to set specific options for some payment methods.

|

|

Authentication object |

Strong Customer Authentication (exemptions, ...)

|

|

Wallets array of strings |

Used to control if wallets should be enabled on the payment selection page.

Possible values: APPLEPAY, GOOGLEPAY.Example: ["APPLEPAY"]

|

|

Payer object |

Information about the payer

|

|

RegisterAlias object |

If the given means of payment should be stored in Saferpay Secure Card Data storage (if applicable)

|

|

ReturnUrl mandatory, object |

URL which is used to redirect the payer back to the shop

This Url is used by Saferpay to redirect the shopper back to the merchant shop. You may add query string parameters to identify your session, but please be aware that the shopper could modify these parameters inside the browser! The whole url including query string parameters should be as short as possible to prevent issues with specific browsers and must not exceed 2000 characters. Note: you should not add sensitive data to the query string, as its contents is plainly visible inside the browser and will be logged by our web servers. |

|

Notification object |

Notification options

|

|

BillingAddressForm object |

Use this container if you need to get a billing address from the payer during the payment process.

Saferpay can show an address form and depending on the means of payment, it is also possible to get the address from the means of payment (e.g. PayPal or any kind of wallet) if available. Check the options in the container for different behaviors. In case you also provide payer addresses, these are used as default values to prefill the address form (if displayed) and are overwritten by the final address entered by the payer or provided by the payment method. |

|

DeliveryAddressForm object |

Use this container if you need to get a delivery address from the payer during the payment process.

Saferpay can show an address form and depending on the means of payment, it is also possible to get the address from the means of payment (e.g. PayPal or any kind of wallet) if available. Check the options in the container for different behaviors. In case you also provide payer addresses, these are used as default values to prefill the address form (if displayed) and are overwritten by the final address entered by the payer or provided by the payment method. |

|

CardForm object |

Options for card data entry form (if applicable)

|

|

Condition string |

Optional Condition for Authorization (only 3DSv2), to control, whether or not, transactions without LiabilityShift should be accepted. Important Note: This only filters out transactions, where the condition is conclusive before the authorization itself. It is possible, that LiabilityShift is rejected after the authorization. Please always check the Liability container, within the authorization-response, to be 100% sure, if LiabilityShift applies, or not!

Possible values: NONE, THREE_DS_AUTHENTICATION_SUCCESSFUL_OR_ATTEMPTED.Default: NONE (empty) |

|

Order object |

Optional order information. Only used for payment method Klarna (mandatory) and for Fraud Intelligence (optional).

|

|

RiskFactors object |

Optional risk factors

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request identifier]",

"RetryIndicator": 0

},

"TerminalId": "[your terminal id]",

"Payment": {

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"OrderId": "Id of the order",

"Description": "Description of payment"

},

"ReturnUrl": {

"Url": "[your shop payment url]"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Token mandatory, string |

Token for later referencing

Example: 234uhfh78234hlasdfh8234e1234

|

|

Expiration mandatory, date |

Expiration date / time of the RedirectUrl in ISO 8601 format in UTC. After this time, the RedirectUrl can't be called anymore.

Example: 2011-07-14T19:43:37+01:00

|

|

RedirectUrl mandatory, string |

RedirectUrl for the payment page transaction. Simply add this to a "Pay Now"-button or do an automatic redirect.

Example: https://www.saferpay.com/vt2/api/PaymentPage/1234/12341234/234uhfh78234hlasdfh8234e1234

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "Id of the request"

},

"Token": "234uhfh78234hlasdfh8234e1234",

"Expiration": "2015-01-30T12:45:22.258+01:00",

"RedirectUrl": "https://www.saferpay.com/vt2/api/..."

}

PaymentPage Assert

POST

Call this function to safely check the status of the transaction from your server.

Important:

- Depending on the payment provider, the resulting transaction may either be an authorization or may already be captured (meaning the financial flow was already triggered). This will be visible in the status of the transaction container returned in the response.

- This function can be called up to 24 hours after the transaction was initialized. For pending transaction the token expiration is increased to 120 hours.

- If the transaction failed (the payer was redirected to the Fail url or he manipulated the return url), an error response with an http status code 400 or higher containing an error message will be returned providing some information on the transaction failure.

Request URL:

POST: /Payment/v1/PaymentPage/Assert

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

Token mandatory, string |

Token returned by initial call.

Id[1..50]Example: 234uhfh78234hlasdfh8234e

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request identifier]",

"RetryIndicator": 0

},

"Token": "234uhfh78234hlasdfh8234e"

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Transaction mandatory, object |

Information about the transaction

|

|

PaymentMeans mandatory, object |

Information about the means of payment

|

|

Payer object |

Information about the payer / card holder

|

|

RegistrationResult object |

Information about the SCD registration outcome

|

|

Liability object |

LiabilityShift information, replaces ThreeDs Info from api version 1.8

|

|

Dcc object |

Dcc information, if applicable

|

|

MastercardIssuerInstallments object |

Mastercard card issuer installment payment options, if applicable

|

|

FraudPrevention object |

Contains details of a performed fraud prevention check

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Transaction": {

"Type": "PAYMENT",

"Status": "AUTHORIZED",

"Id": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"Date": "2015-01-30T12:45:22.258+01:00",

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"AcquirerName": "Saferpay Test Card",

"AcquirerReference": "000000",

"SixTransactionReference": "0:0:3:723n4MAjMdhjSAhAKEUdA8jtl9jb",

"ApprovalCode": "012345"

},

"PaymentMeans": {

"Brand": {

"PaymentMethod": "VISA",

"Name": "VISA Saferpay Test"

},

"DisplayText": "9123 45xx xxxx 1234",

"Card": {

"MaskedNumber": "912345xxxxxx1234",

"ExpYear": 2015,

"ExpMonth": 9,

"HolderName": "Max Mustermann",

"CountryCode": "CH"

}

},

"Liability": {

"LiabilityShift": true,

"LiableEntity": "THREEDS",

"ThreeDs": {

"Authenticated": true,

"Xid": "ARkvCgk5Y1t/BDFFXkUPGX9DUgs="

}

}

}

Transaction

Payment Process with the Transaction Interface

This chapter will give you a simple overview about the general transaction flow, when using the Transaction Interface.

Important Note: The Transaction Interface offers all sorts of options to perform transactions. This flow only describes the general flow. Furthermore, you may want to read our Saferpay Integration guide, which offers an in depth explanation on how to integrate the Transaction Interface, optional features, best practices and more.

Transaction-flow

- Transaction Initialize

- Initializes the Payment and generates the RedirectUrl for the iFrame Integration.

- Open the RedirectUrl inside an HTML-iFrame, to show the hosted card entry form!

- Return to ReturnUrl. The ReturnUrl is defined in step 1!

- Transaction Authorize

- Authorizes the card, which has been gathered in step 2. Up until now, no transaction has been made!

- Depending on the outcome of step 4 you may

- Transaction is finished!

Transaction Initialize Available depending on license

POST

This method may be used to start a transaction which may involve either DCC and / or 3d-secure.

Warning: Only PCI certified merchants may submit the card-data directly, or use their own HTML form! Click here for more information!

Request URL:

POST: /Payment/v1/Transaction/Initialize

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

ConfigSet string |

This parameter let you define your payment page config (PPConfig) by name. If this parameters is not set, your default PPConfig will be applied if available.

Id[1..20]When the PPConfig can't be found (e.g. wrong name), the Saferpay basic style will be applied to the payment page. Example: name of your payment page config (case-insensitive)

|

|

TerminalId mandatory, string |

Saferpay terminal to use for this authorization

Numeric[8..8]Example: 12341234

|

|

Payment mandatory, object |

Information about the payment (amount, currency, ...)

|

|

PaymentMeans object |

Means of payment (either card data or a reference to a previously stored card).

Important: Only fully PCI certified merchants may directly use the card data. If your system is not explicitly certified to handle card data directly, then use the Saferpay Secure Card Data-Storage instead. If the customer enters a new card, you may want to use the Saferpay Hosted Register Form to capture the card data through Saferpay. |

|

Authentication object |

Strong Customer Authentication (exemptions, ...)

|

|

Payer object |

Information on the payer (IP-address)

|

|

ReturnUrl mandatory, object |

URL which is used to redirect the payer back to the shop if the transaction requires some kind of browser redirection (3d-secure, dcc)

This Url is used by Saferpay to redirect the shopper back to the merchant shop. You may add query string parameters to identify your session, but please be aware that the shopper could modify these parameters inside the browser! The whole url including query string parameters should be as short as possible to prevent issues with specific browsers and must not exceed 2000 characters. Note: you should not add sensitive data to the query string, as its contents is plainly visible inside the browser and will be logged by our web servers. |

|

Styling object |

Styling options

|

|

PaymentMethods array of strings |

Used to restrict the means of payment which are available to the payer

Possible values: AMEX, BANCONTACT, BONUS, DINERS, DIRECTDEBIT, JCB, MAESTRO, MASTERCARD, MYONE, VISA. Additional values may be accepted but are ignored.Example: ["VISA", "MASTERCARD"]

|

|

Order object |

Optional order information. Only used for payment method Klarna (mandatory) and for Fraud Intelligence (optional).

|

|

RiskFactors object |

Optional risk factors

|

|

CardForm object |

Options for card data entry form (if applicable)

|

|

RedirectNotifyUrls object |

If a redirect of the payer is required, these URLs will be used by Saferpay to notify you when the payer has completed the required steps and the transaction is ready to be authorized or when the operation has failed or has been aborted by the payer.

If no redirect of the payer is required, then these URLs will not be called (see RedirectRequired attribute of the Transaction Initialize response). Supported schemes are http and https. You also have to make sure to support the GET-method. The whole url including query string parameters must not exceed 2000 characters. Note: you should not add sensitive data to the query string, as its contents are logged by our web servers. |

|

Notification object |

Notification options

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request id]",

"RetryIndicator": 0

},

"TerminalId": "[your terminal id]",

"Payment": {

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

}

},

"Payer": {

"LanguageCode": "en"

},

"ReturnUrl": {

"Url": "[your shop payment url]"

},

"Styling": {

"CssUrl": "[your shop css url]"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Token mandatory, string |

Id for referencing later

Example: 234uhfh78234hlasdfh8234e

|

|

Expiration mandatory, date |

Expiration date / time of the generated token in ISO 8601 format in UTC.

Example: After this time is exceeded, the token will not be accepted for any further actions except Asserts. 2015-01-30T13:45:22.258+02:00

|

|

LiabilityShift boolean |

Indicates if liability shift to issuer is possible or not. Not present if PaymentMeans container was not present in InitializeTransaction request. True, if liability shift to issuer is possible, false if not.

|

|

RedirectRequired mandatory, boolean |

True if a redirect must be performed to continue, false otherwise

|

|

Redirect object |

Mandatory if RedirectRequired is true. Contains the URL for the redirect to use for example the Saferpay hosted register form.

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Token": "234uhfh78234hlasdfh8234e",

"Expiration": "2015-01-30T12:45:22.258+01:00",

"LiabilityShift": true,

"RedirectRequired": true,

"Redirect": {

"RedirectUrl": "https://www.saferpay.com/vt2/Api/...",

"PaymentMeansRequired": true

}

}

Transaction Authorize Available depending on license

POST

This function may be called to authorize a transaction which was started by a call to Transaction/Initialize.

Request URL:

POST: /Payment/v1/Transaction/Authorize

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

Token mandatory, string |

Token returned by Initialize

Id[1..50]Example: 234uhfh78234hlasdfh8234e

|

|

Condition string |

THREE_DS_AUTHENTICATION_SUCCESSFUL_OR_ATTEMPTED: the authorization will be executed if the previous 3d-secure process indicates that the liability shift to the issuer is possible

Possible values: NONE, THREE_DS_AUTHENTICATION_SUCCESSFUL_OR_ATTEMPTED.(liability shift may still be declined with the authorization though). This condition will be ignored for brands which Saferpay does not offer 3d-secure for. --- If left out, the authorization will be done if allowed, but possibly without liability shift to the issuer. See the specific result codes in the response message. Example: NONE

|

|

VerificationCode string |

Card verification code if available

Numeric[3..4]Example: 123

|

|

RegisterAlias object |

Controls whether the given means of payment should be stored inside the Saferpay Secure Card Data storage.

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request id]",

"RetryIndicator": 0

},

"Token": "sdu5ymxx210y2dz1ggig2ey0o",

"VerificationCode": "123"

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Transaction mandatory, object |

Information about the transaction

|

|

PaymentMeans mandatory, object |

Information about the means of payment

|

|

Payer object |

Information about the payer / card holder

|

|

RegistrationResult object |

Information about the Secure Card Data registration outcome.

|

|

MastercardIssuerInstallments object |

Mastercard card issuer installment payment options, if applicable

|

|

Liability object |

LiabilityShift information, replaces ThreeDs Info from API version 1.8

|

|

Dcc object |

Dcc information, if applicable

|

|

FraudPrevention object |

Contains details of a performed fraud prevention check

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Transaction": {

"Type": "PAYMENT",

"Status": "AUTHORIZED",

"Id": "MUOGAWA9pKr6rAv5dUKIbAjrCGYA",

"Date": "2015-09-18T09:19:27.078Z",

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"AcquirerName": "AcquirerName",

"AcquirerReference": "Reference",

"SixTransactionReference": "0:0:3:MUOGAWA9pKr6rAv5dUKIbAjrCGYA",

"ApprovalCode": "012345"

},

"PaymentMeans": {

"Brand": {

"PaymentMethod": "VISA",

"Name": "VISA Saferpay Test"

},

"DisplayText": "9123 45xx xxxx 1234",

"Card": {

"MaskedNumber": "912345xxxxxx1234",

"ExpYear": 2015,

"ExpMonth": 9,

"HolderName": "Max Mustermann",

"CountryCode": "CH"

}

},

"Payer": {

"IpAddress": "1.2.3.4",

"IpLocation": "DE"

},

"Liability": {

"LiabilityShift": true,

"LiableEntity": "THREEDS",

"ThreeDs": {

"Authenticated": true,

"Xid": "ARkvCgk5Y1t/BDFFXkUPGX9DUgs="

}

}

}

Transaction AuthorizeDirect Available depending on license

POST

This function may be used to directly authorize transactions which do not require a redirect of the customer (e.g. direct debit or recurring transactions based on a previously registered alias).

Warning: Only PCI certified merchants may submit the card-data directly, or use their own HTML form! Click here for more information!

Important: This function does not perform 3D Secure! Only the PaymentPage or Transaction Initialize do support 3D Secure!

Request URL:

POST: /Payment/v1/Transaction/AuthorizeDirect

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TerminalId mandatory, string |

Saferpay Terminal-Id

Numeric[8..8]Example: 12341234

|

|

Payment mandatory, object |

Information about the payment (amount, currency, ...)

|

|

PaymentMeans mandatory, object |

Information on the means of payment. Important: Only fully PCI certified merchants may directly use the card data. If your system is not explicitly certified to handle card data directly, then use the Saferpay Secure Card Data-Storage instead. If the customer enters a new card, you may want to use the Saferpay Hosted Register Form to capture the card data through Saferpay.

|

|

Authentication object |

Strong Customer Authentication exemption for this transaction.

Some exemptions are only applicable to payer-initiated transactions and will be ignored otherwise. If you are performing a payer-initiated transaction, make sure you set the 'Initiator' attribute properly (see below). |

|

RegisterAlias object |

Controls whether the given means of payment should be stored inside the Saferpay Secure Card Data storage.

|

|

Payer object |

Information on the payer (IP-address)

|

|

Order object |

Optional order information. Only used for payment method Klarna (mandatory) and for Fraud Intelligence (optional).

|

|

RiskFactors object |

Optional risk factors

|

|

Initiator string |

Specify if the transaction was initiated by the merchant (default behavior if not specified) or by the payer.

Possible values: MERCHANT, PAYER.This is relevant for most credit and debit cards managed by Mastercard, Visa and American Express card schemes (in card scheme jargon: MERCHANT means MIT, PAYER means CIT). For these schemes, transactions initiated by the payer usually require authentication of the card holder, which is not possible if you use Transaction/AuthorizeDirect (use Transaction/Initialize or PaymentPage/Initialize if you're not sure). Saferpay will flag the transaction accordingly (also taking the optional Exemption in the Authentication container into account) on the protocols which support this and card issuers might approve or decline transactions depending on this flagging. Example: MERCHANT

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request id]",

"RetryIndicator": 0

},

"TerminalId": "[your terminal id]",

"Payment": {

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"Description": "Test123",

"PayerNote": "Order123_Testshop"

},

"PaymentMeans": {

"Card": {

"Number": "912345678901234",

"ExpYear": 2015,

"ExpMonth": 9,

"HolderName": "Max Mustermann",

"VerificationCode": "123"

}

},

"Authentication": {

"Exemption": "RECURRING"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Transaction mandatory, object |

Information about the transaction

|

|

PaymentMeans mandatory, object |

Information about the means of payment

|

|

Payer object |

Information about the payer / card holder

|

|

RegistrationResult object |

Information about the Secure Card Data registration outcome.

|

|

MastercardIssuerInstallments object |

Mastercard card issuer installment payment options, if applicable

|

|

FraudPrevention object |

Contains details of a performed fraud prevention check

|

|

Liability object |

LiabilityShift information, replaces ThreeDs Info from api version 1.26

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Transaction": {

"Type": "PAYMENT",

"Status": "AUTHORIZED",

"Id": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"Date": "2015-01-30T12:45:22.258+01:00",

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"AcquirerName": "AcquirerName",

"AcquirerReference": "Reference",

"SixTransactionReference": "0:0:3:723n4MAjMdhjSAhAKEUdA8jtl9jb",

"ApprovalCode": "012345"

},

"PaymentMeans": {

"Brand": {

"PaymentMethod": "VISA",

"Name": "VISA Saferpay Test"

},

"DisplayText": "9123 45xx xxxx 1234",

"Card": {

"MaskedNumber": "912345xxxxxx1234",

"ExpYear": 2015,

"ExpMonth": 7,

"HolderName": "Max Mustermann",

"CountryCode": "CH"

}

},

"Payer": {

"IpAddress": "1.2.3.4",

"IpLocation": "DE"

}

}

Transaction AuthorizeReferenced Available depending on license

POST

This method may be used to perform follow-up authorizations to an earlier transaction. At this time, the referenced (initial) transaction must have been performed setting either the recurring or installment option.

Request URL:

POST: /Payment/v1/Transaction/AuthorizeReferenced

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TerminalId mandatory, string |

Saferpay Terminal-Id

Numeric[8..8]Example: 12341234

|

|

Payment mandatory, object |

Information about the payment (amount, currency, ...)

|

|

TransactionReference mandatory, object |

Reference to previous transaction.

Exactly one element must be set. |

|

Authentication object |

Strong Customer Authentication (exemptions, ...)

|

|

SuppressDcc boolean |

Used to suppress direct currency conversion

|

|

Notification object |

Notification options

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request id]",

"RetryIndicator": 0

},

"TerminalId": "[your terminal id]",

"Payment": {

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"Description": "Test123",

"PayerNote": "Order123_Testshop"

},

"Authentication": {

"Exemption": "RECURRING"

},

"TransactionReference": {

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Transaction mandatory, object |

Information about the transaction

|

|

PaymentMeans mandatory, object |

Information about the means of payment

|

|

Payer object |

Information about the payer / card holder

|

|

Dcc object |

Dcc information, if applicable

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Transaction": {

"Type": "PAYMENT",

"Status": "AUTHORIZED",

"Id": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"Date": "2015-01-30T12:45:22.258+01:00",

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"AcquirerName": "AcquirerName",

"AcquirerReference": "Reference",

"SixTransactionReference": "0:0:3:723n4MAjMdhjSAhAKEUdA8jtl9jb",

"ApprovalCode": "012345"

},

"PaymentMeans": {

"Brand": {

"PaymentMethod": "VISA",

"Name": "VISA Saferpay Test"

},

"DisplayText": "9123 45xx xxxx 1234",

"Card": {

"MaskedNumber": "912345xxxxxx1234",

"ExpYear": 2015,

"ExpMonth": 7,

"HolderName": "Max Mustermann",

"CountryCode": "CH"

}

},

"Payer": {

"IpAddress": "1.2.3.4",

"IpLocation": "DE"

},

"Dcc": {

"PayerAmount": {

"Value": "109",

"CurrencyCode": "USD"

}

}

}

Transaction Capture Available depending on license

POST

This method may be used to finalize previously authorized transactions and refunds.

Request URL:

POST: /Payment/v1/Transaction/Capture

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TransactionReference mandatory, object |

Reference to authorization.

Exactly one element must be set. |

|

Amount object |

Currency must match the original transaction currency (request will be declined if currency does not match)

|

|

Billpay object |

Optional Billpay specific options.

|

|

PendingNotification object |

Optional pending notification capture options for Paydirekt transactions.

|

|

Marketplace object |

Optional Marketplace capture parameters.

|

|

MastercardIssuerInstallments object |

Selected Mastercard card issuer installment payment option, if applicable

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request id]",

"RetryIndicator": 0

},

"TransactionReference": {

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

CaptureId string |

CaptureId of the created capture. Must be stored for later reference (eg refund).

Id[1..64]Example: ECthWpbv1SI6SAIdU2p6AIC1bppA_c

|

|

Status mandatory, string |

Current status of the capture. (PENDING is only used for paydirekt at the moment)

Possible values: PENDING, CAPTURED. |

|

Date mandatory, date |

Date and time of capture. Not set if the capture state is pending.

Example: 2014-04-25T08:33:44.159+01:00

|

|

Invoice object |

Optional infos for invoice based payments.

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"CaptureId": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"Status": "CAPTURED",

"Date": "2015-01-30T12:45:22.258+01:00"

}

Transaction MultipartCapture Available depending on license

POST

This method may be used to capture multiple parts of an authorized transaction.

Important:

- MultipartCapture is available for PayPal, Klarna and card payments Visa, Mastercard, Maestro, Diners/Discover, JCB and American Express which are acquired by Worldline.

- No MultipartCapture request should be sent before receiving the response of a preceding request (i.e. no parallel calls are allowed).

- The sum of multipart captures must not exceed the authorized amount.

- A unique OrderPartId must be used for each request.

Request URL:

POST: /Payment/v1/Transaction/MultipartCapture

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TransactionReference mandatory, object |

Reference to authorization.

Exactly one element must be set. |

|

Amount mandatory, object |

Currency must match the original transaction currency (request will be declined if currency does not match)

|

|

Type mandatory, string |

'PARTIAL' if more captures should be possible later on, 'FINAL' if no more captures will be done on this authorization.

Possible values: PARTIAL, FINAL. |

|

OrderPartId mandatory, string |

Must be unique. It identifies each individual step and is especially important for follow-up actions such as refund.

Id[1..80]Example: kh9ngajrfe6wfu3d0c

|

|

Marketplace object |

Optional Marketplace capture parameters.

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request identifier]",

"RetryIndicator": 0

},

"TransactionReference": {

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb"

},

"Amount": {

"Value": "1000",

"CurrencyCode": "CHF"

},

"Type": "PARTIAL",

"OrderPartId": "123456789",

"Marketplace": {

"SubmerchantId": "17312345",

"Fee": {

"Value": "500",

"CurrencyCode": "CHF"

}

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

CaptureId string |

CaptureId of the created capture. Must be stored for later reference (eg refund).

Id[1..64]Example: ECthWpbv1SI6SAIdU2p6AIC1bppA_c

|

|

Status mandatory, string |

Current status of the capture. (PENDING is only used for paydirekt at the moment)

Possible values: PENDING, CAPTURED. |

|

Date mandatory, date |

Date and time of capture. Not set if the capture state is pending.

Example: 2018-08-08T12:45:22.258+01:00

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[unique request identifier]"

},

"CaptureId": "723n4MAjMdhjSAhAKEUdA8jtl9jb_c",

"Status": "CAPTURED",

"Date": "2018-08-08T13:45:22.258+02:00"

}

Transaction AssertCapture Available depending on license

POST

Attention: This method is only supported for pending captures. A pending capture is only applicable for paydirekt transactions at the moment.

Request URL:

POST: /Payment/v1/Transaction/AssertCapture

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

CaptureReference mandatory, object |

Reference to the capture.

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request id]",

"RetryIndicator": 0

},

"CaptureReference": {

"CaptureId": "24218eabae254caea6f898e413fe_c"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

TransactionId mandatory, string |

Id of the referenced transaction.

AlphaNumeric[1..64]Example: 723n4MAjMdhjSAhAKEUdA8jtl9jb

|

|

OrderId string |

OrderId of the referenced transaction. If present.

Id[1..80]Example: c52ad18472354511ab2c33b59e796901

|

|

Status mandatory, string |

Current status of the capture. (PENDING is only used for paydirekt at the moment)

Possible values: PENDING, CAPTURED. |

|

Date mandatory, date |

Date and time of capture. Not set if the capture state is pending.

Example: 2014-04-25T08:33:44.159+01:00

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"Status": "CAPTURED",

"Date": "2015-01-30T12:45:22.258+01:00"

}

Transaction MultipartFinalize Available depending on license

POST

This method may be used to finalize a transaction having one or more partial captures (i.e. marks the end of partial captures).

Request URL:

POST: /Payment/v1/Transaction/MultipartFinalize

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TransactionReference mandatory, object |

Reference to authorization.

Exactly one element must be set. |

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request identifier]",

"RetryIndicator": 0

},

"TransactionReference": {

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[unique request identifier]"

}

}

Transaction Refund Available depending on license

POST

This method may be called to refund a previous transaction.

Request URL:

POST: /Payment/v1/Transaction/Refund

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

Refund mandatory, object |

Information about the refund (amount, currency, ...)

|

|

CaptureReference mandatory, object |

Reference to the capture you want to refund.

|

|

PendingNotification object |

Optional pending notification options

|

|

PaymentMethodsOptions object |

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[your request id]",

"RetryIndicator": 0

},

"Refund": {

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

}

},

"CaptureReference": {

"CaptureId": "723n4MAjMdhjSAhAKEUdA8jtl9jb_c"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Transaction mandatory, object |

Information about the transaction

|

|

PaymentMeans mandatory, object |

Information about the means of payment

|

|

Dcc object |

Dcc information, if applicable

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Transaction": {

"Type": "REFUND",

"Status": "AUTHORIZED",

"Id": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"Date": "2015-01-30T12:45:22.258+01:00",

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"AcquirerName": "Saferpay Test",

"AcquirerReference": "000000",

"SixTransactionReference": "0:0:3:723n4MAjMdhjSAhAKEUdA8jtl9jb",

"ApprovalCode": "012345"

},

"PaymentMeans": {

"Brand": {

"PaymentMethod": "VISA",

"Name": "VISA Saferpay Test"

},

"DisplayText": "9123 45xx xxxx 1234",

"Card": {

"MaskedNumber": "912345xxxxxx1234",

"ExpYear": 2015,

"ExpMonth": 9,

"HolderName": "Max Mustermann",

"CountryCode": "CH"

}

}

}

Transaction AssertRefund Available depending on license

POST

This method may be used to inquire the status and further information of pending refunds.

Attention: This method is only supported for pending refunds. A pending refund is only applicable for paydirekt or WL Crypto Payments transactions at the moment.

Request URL:

POST: /Payment/v1/Transaction/AssertRefund

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TransactionReference mandatory, object |

Reference to authorization.

Exactly one element must be set. |

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request id]",

"RetryIndicator": 0

},

"TransactionReference": {

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

TransactionId mandatory, string |

Id of the referenced transaction.

AlphaNumeric[1..64]Example: 723n4MAjMdhjSAhAKEUdA8jtl9jb

|

|

OrderId string |

OrderId of the referenced transaction. If present.

Id[1..80]Example: c52ad18472354511ab2c33b59e796901

|

|

Status mandatory, string |

Current status of the capture. (PENDING is only used for paydirekt at the moment)

Possible values: PENDING, CAPTURED. |

|

Date mandatory, date |

Date and time of capture. Not set if the capture state is pending.

Example: 2014-04-25T08:33:44.159+01:00

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"Status": "CAPTURED",

"Date": "2015-01-30T12:45:22.258+01:00"

}

Transaction RefundDirect Available depending on license

POST

This method may be called to refund an amount to the given means of payment (not supported for all means of payment) without referencing a previous transaction. This might be the case if the original transaction was done with a card which is not valid any more.

Warning: Only PCI certified merchants may submit the card-data directly, or use their own HTML form! Click here for more information!

Request URL:

POST: /Payment/v1/Transaction/RefundDirect

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TerminalId mandatory, string |

Saferpay Terminal-Id

Numeric[8..8]Example: 12341234

|

|

Refund mandatory, object |

Information about the refund (amount, currency, ...)

|

|

PaymentMeans mandatory, object |

Information on the means of payment. Important: Only fully PCI certified merchants may directly use the card data.

If your system is not explicitly certified to handle card data directly, then use the Saferpay Secure Card Data-Storage instead. If the customer enters a new card, you may want to use the Saferpay Hosted Register Form to capture the card data through Saferpay. |

|

OriginalCreditTransfer object |

Information about the Original Credit Transfer like the Address of the Recipient.

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[your request id]",

"RetryIndicator": 0

},

"TerminalId": "[your terminal id]",

"Refund": {

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

}

},

"PaymentMeans": {

"Alias": {

"Id": "alias35nfd9mkzfw0x57iwx"

}

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Transaction mandatory, object |

Information about the transaction

|

|

PaymentMeans mandatory, object |

Information about the means of payment

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Transaction": {

"Type": "REFUND",

"Status": "AUTHORIZED",

"Id": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"Date": "2015-01-30T12:45:22.258+01:00",

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

},

"AcquirerName": "Saferpay Test",

"AcquirerReference": "000000",

"SixTransactionReference": "0:0:3:723n4MAjMdhjSAhAKEUdA8jtl9jb",

"ApprovalCode": "012345"

},

"PaymentMeans": {

"Brand": {

"PaymentMethod": "VISA",

"Name": "VISA Saferpay Test"

},

"DisplayText": "9123 45xx xxxx 1234",

"Card": {

"MaskedNumber": "912345xxxxxx1234",

"ExpYear": 2015,

"ExpMonth": 9,

"HolderName": "Max Mustermann",

"CountryCode": "CH"

}

}

}

Transaction Cancel Available depending on license

POST

This method may be used to cancel previously authorized transactions and refunds.

Request URL:

POST: /Payment/v1/Transaction/Cancel

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TransactionReference mandatory, object |

Reference to transaction to be canceled.

Exactly one element must be set. |

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request id]",

"RetryIndicator": 0

},

"TransactionReference": {

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

TransactionId mandatory, string |

Id of the referenced transaction.

Example: qiuwerhfi23h4189asdhflk23489

|

|

OrderId string |

OrderId of the referenced transaction. If present.

Example: c52ad18472354511ab2c33b59e796901

|

|

Date mandatory, date |

Date and time of cancel.

Example: 2014-04-25T08:33:44.159+01:00

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"TransactionId": "723n4MAjMdhjSAhAKEUdA8jtl9jb",

"OrderId": "c52ad18472354511ab2c33b59e796901",

"Date": "2015-01-30T12:45:22.258+01:00"

}

Transaction RedirectPayment Available depending on license

POST

WARNING: This feature is deprecated and replaced by the Payment Page. Please use the parameter PaymentMethods to directly select the desired 3rd party provider!

Request URL:

POST: /Payment/v1/Transaction/RedirectPayment

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

TerminalId mandatory, string |

Saferpay terminal to use for this authorization

Numeric[8..8]Example: 12341234

|

|

Payment mandatory, object |

Information about the payment (amount, currency, ...)

|

|

ServiceProvider mandatory, string |

Service provider to be used for this payment

Possible values: POSTCARD, POSTFINANCE.Example: POSTFINANCE

|

|

Payer object |

Information on the payer (IP-address)

|

|

ReturnUrl mandatory, object |

URL which is used to redirect the payer back to the shop if the transaction requires some kind of browser redirection (3d-secure, dcc)

This Url is used by Saferpay to redirect the shopper back to the merchant shop. You may add query string parameters to identify your session, but please be aware that the shopper could modify these parameters inside the browser! The whole url including query string parameters should be as short as possible to prevent issues with specific browsers and must not exceed 2000 characters. Note: you should not add sensitive data to the query string, as its contents is plainly visible inside the browser and will be logged by our web servers. |

|

Styling object |

Custom styling resource

|

|

Notification object |

Notification options

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[your request id]",

"RetryIndicator": 0

},

"TerminalId": "[your terminal id]",

"Payment": {

"Amount": {

"Value": "100",

"CurrencyCode": "CHF"

}

},

"ServiceProvider": "PAYPAL",

"ReturnUrl": {

"Url": "[your shop payment url]"

}

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Token mandatory, string |

Id for referencing later

Example: 234uhfh78234hlasdfh8234e

|

|

Expiration mandatory, date |

Expiration date / time of the generated token in ISO 8601 format in UTC. After this time, the token won’t be accepted for any further action.

Example: 2015-01-30T13:45:22.258+02:00

|

|

RedirectUrl string |

Url to redirect the browser to for payment processing

Example: https://www.saferpay.com/VT2/api/...

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Token": "234uhfh78234hlasdfh8234e",

"Expiration": "2015-01-30T12:45:22.258+01:00",

"RedirectUrl": "https://www.saferpay.com/vt2/Api/..."

}

Transaction AssertRedirectPayment Available depending on license

POST

WARNING: This feature is deprecated and replaced by the Payment Page. Please use the parameter PaymentMethods to directly select the desired 3rd party provider!

Request URL:

POST: /Payment/v1/Transaction/AssertRedirectPayment

Request

| Arguments | |

|---|---|

|

RequestHeader mandatory, object |

General information about the request.

|

|

Token mandatory, string |

Token returned by initial call.

Id[1..50]Example: 234uhfh78234hlasdfh8234e

|

Example:

{

"RequestHeader": {

"SpecVersion": "[current Spec-Version]",

"CustomerId": "[your customer id]",

"RequestId": "[unique request identifier]",

"RetryIndicator": 0

},

"Token": "234uhfh78234hlasdfh8234e"

}

Response

| Arguments | |

|---|---|

|

ResponseHeader mandatory, object |

Contains general information about the response.

|

|

Transaction mandatory, object |

Information about the transaction

|

|

PaymentMeans mandatory, object |

Information about the means of payment

|

|

Payer object |

Information about the payer / card holder

|

Example:

{

"ResponseHeader": {

"SpecVersion": "[current Spec-Version]",

"RequestId": "[your request id]"

},

"Transaction": {

"Type": "PAYMENT",

"Status": "AUTHORIZED",

"Id": "723n4MAjMdhjSAhAKEUdA8jtl9jb",