PayPal

Paypal payments can be processed with Saferpay without much effort. This chapter describes what needs to be considered in this regard.

Requirements

The handling of PayPal payments with Saferpay requires:

- The corresponding Saferpay eCommerce licence and thus the existence of a valid identification with a username and password for the Saferpay system.

- Availability of at least one active Saferpay terminal via which payment can be carried out and availability of the associated Saferpay TerminalId.

- A valid PayPal merchant account.

- PayPal is only available via the PaymentPage flow!

- NotifyUrl: The NotifyUrl is mandatory, in order to avoid missing payment successes. See the Payment Page process for further information!

Attention: For PayPal activation on the Saferpay terminal, please inform our activation service about your PayPal merchant account ID and the desired currency.

Grant API Approval for Saferpay

To enable processing of PayPal payments via Saferpay a few settings must be first specified in the PayPal Mercahnt account.

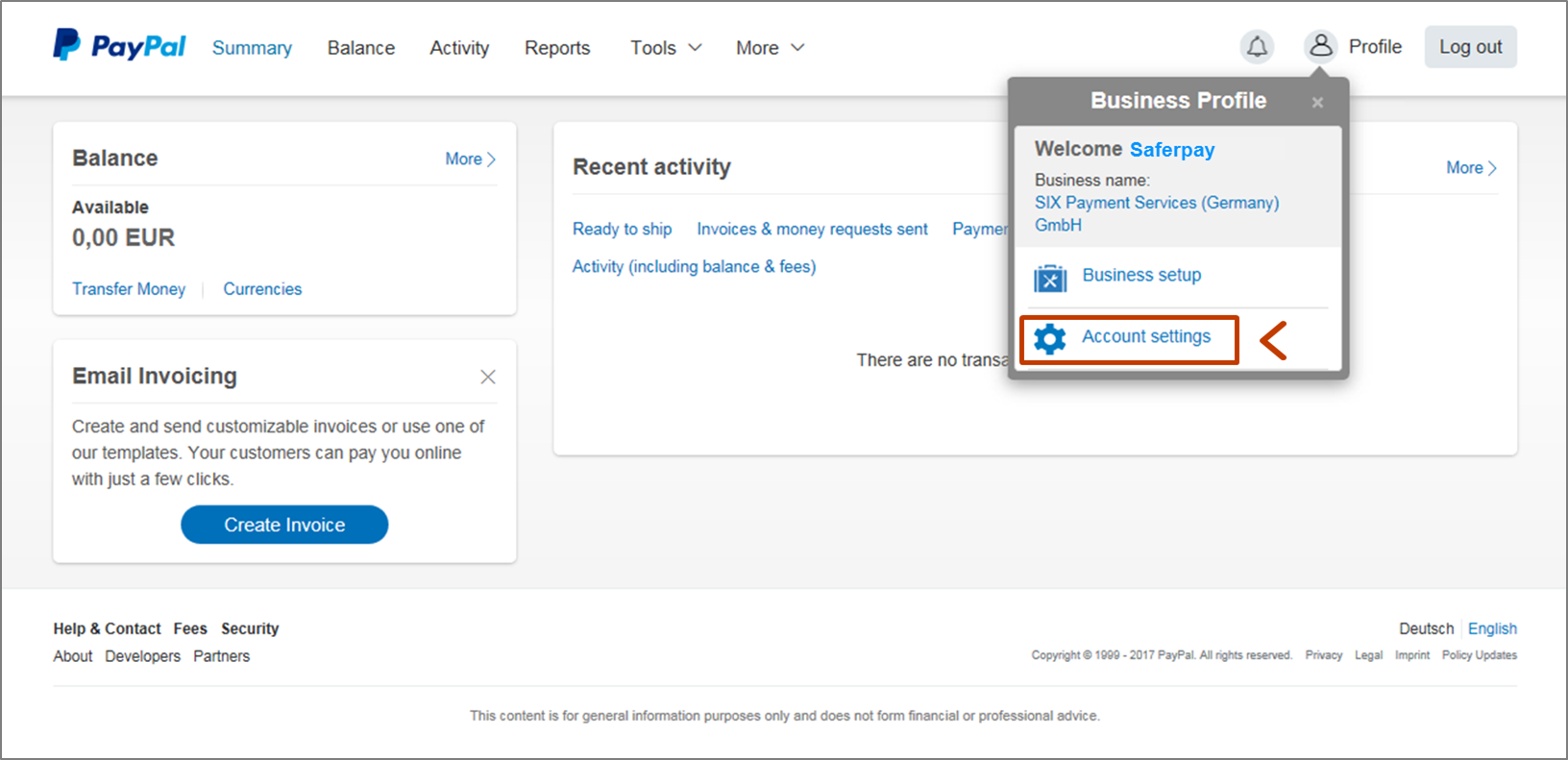

- Log in to your PayPal business account at www.paypal.com.

- Click on the profile icon

on the top right side of the page. From the Business Profile menu, select Account Settings.

on the top right side of the page. From the Business Profile menu, select Account Settings.

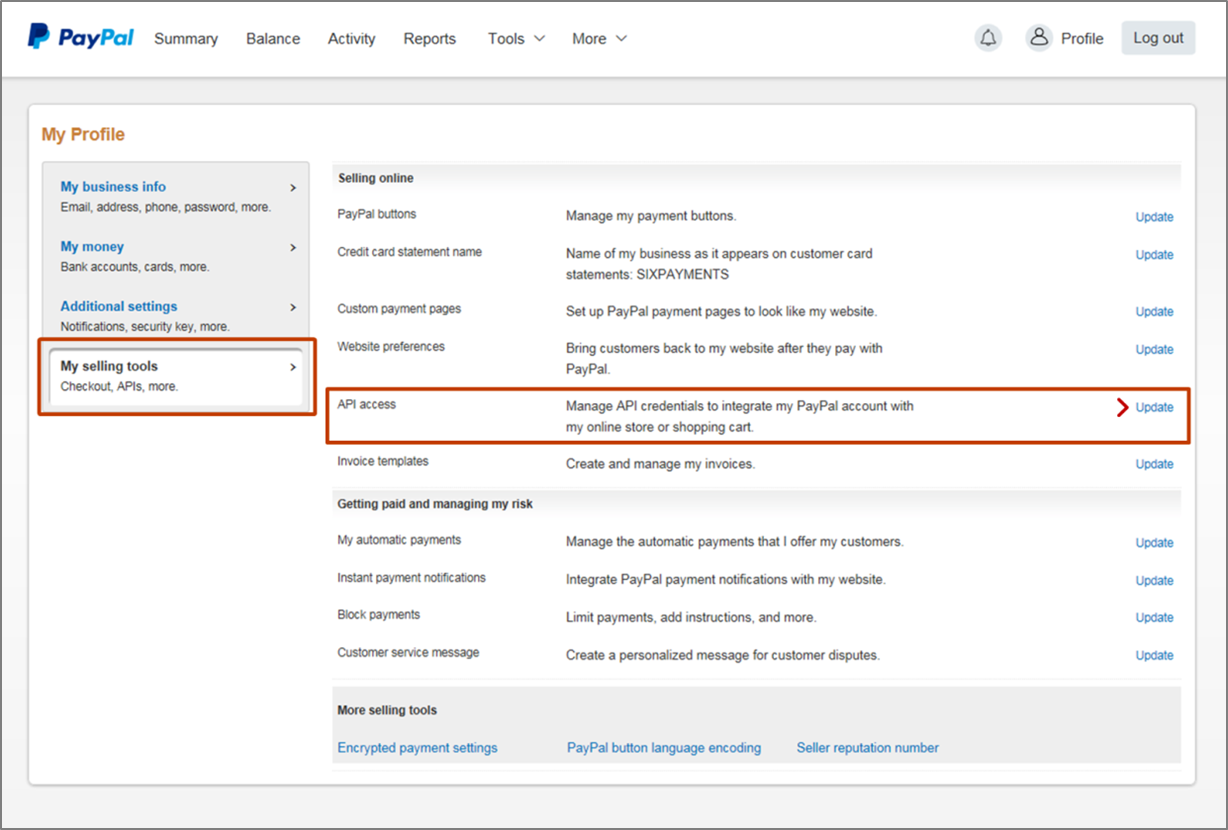

- From the left menu, click My selling tools.

- In the Selling online section, click the Update link for the API access item.

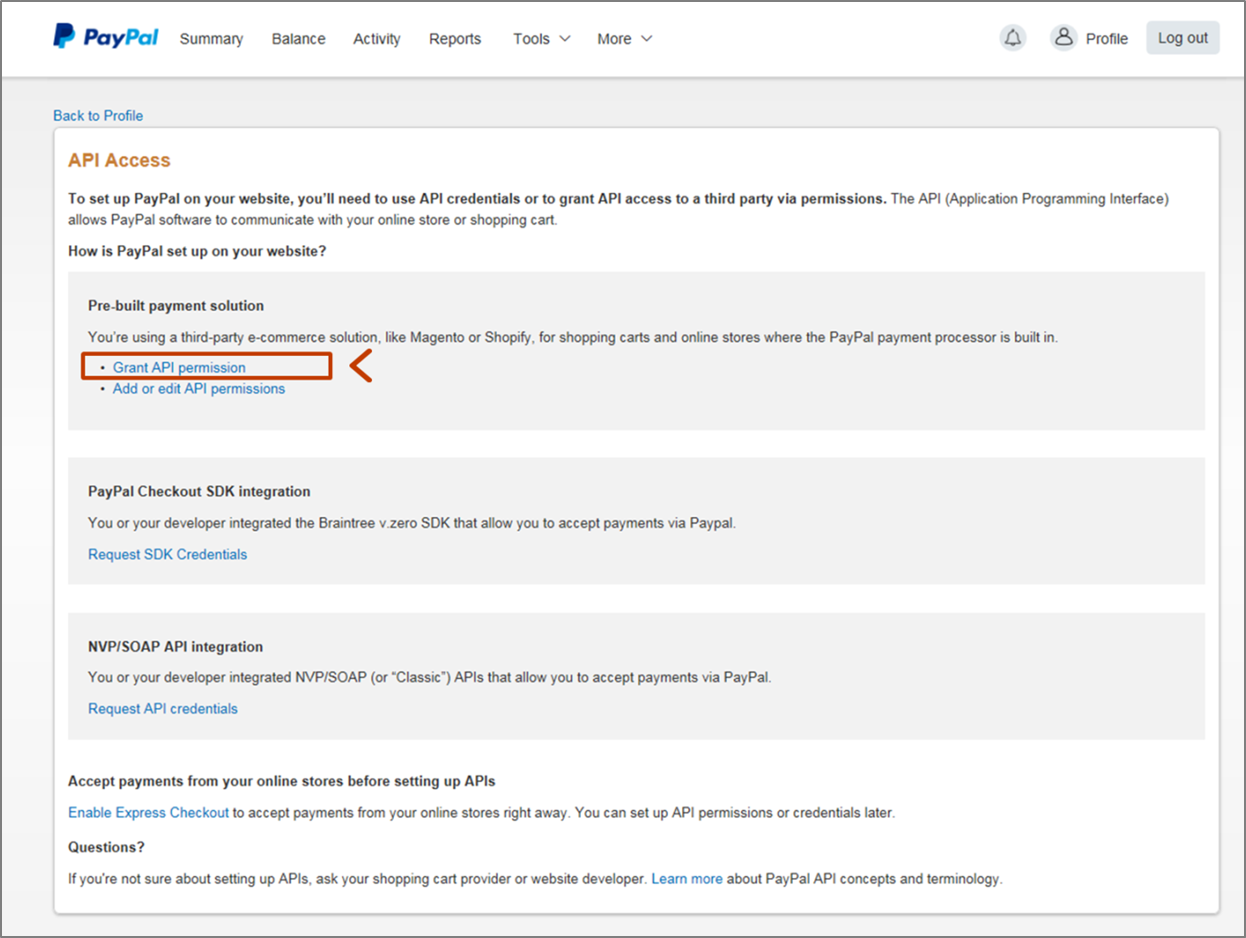

- The API Access dialogue appears. Click on Grant API permission under the bullet point Pre-built payment solution.

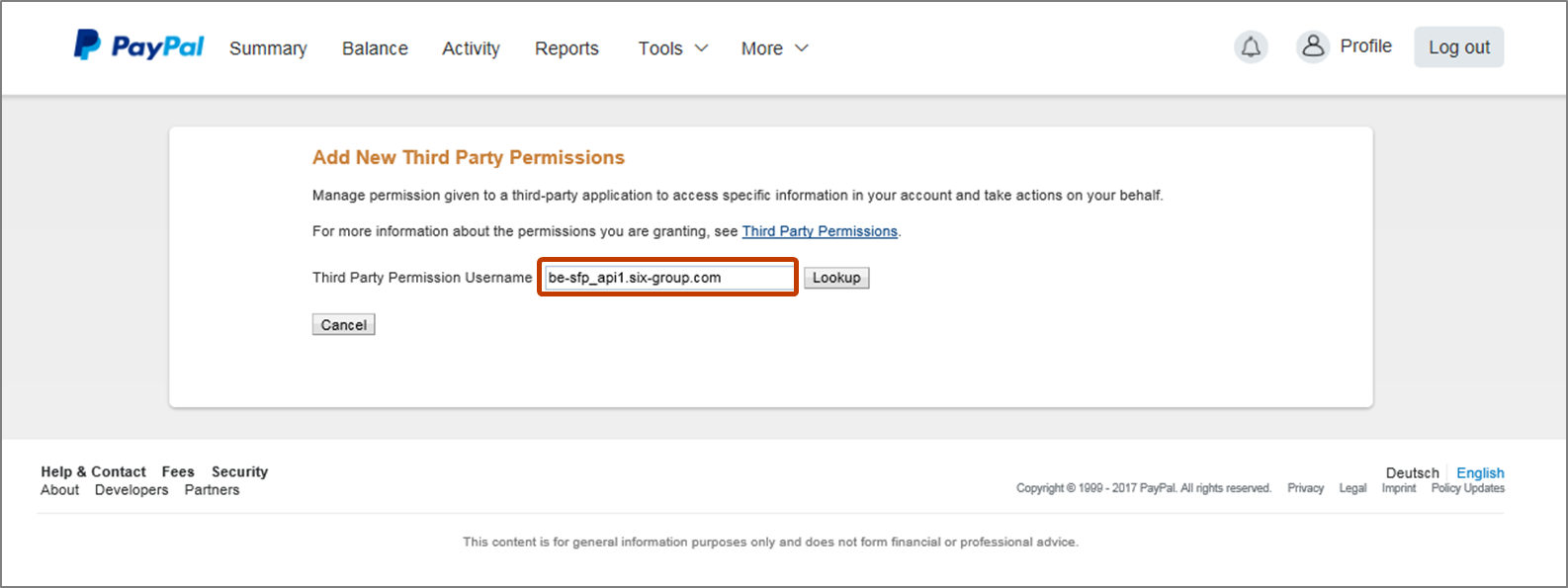

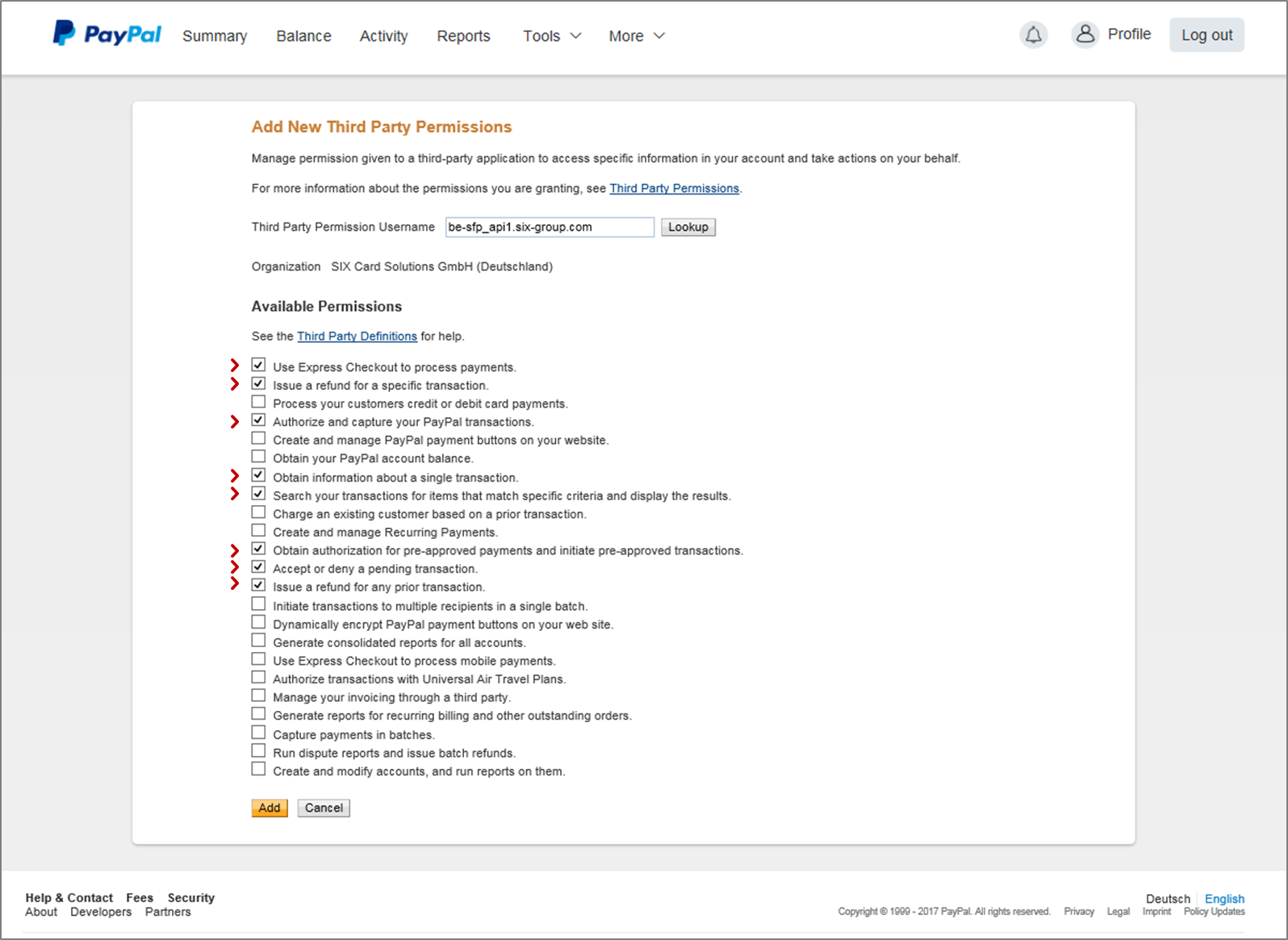

- The dialogue Add New Third Party Permissions appears:

Enter be-sfp_api1.six-group.com into Third Party Permission Username box. Click on Lookup.

- The Available Permissions list will be shown:

Tick the following checkboxes and then click on Add:

- Use Express Checkout to process payments.

- Issue a refund for a specific transaction.

- Authorize and capture your PayPal transactions.

- Obtain information about a single transaction.

- Search your transactions for items that match specific criteria and display the results

- Obtain authorization for pre-approved payments and initiate pre-approved transactions.

- Accept or deny a pending transaction.

- Issue a refund for any prior transaction.

Capture and the solvency of the customer

Unlike credit cards, that give the merchant a certain guarantee for the authorized money, PayPal reserves the right to deny the payout of a transaction, if the solvency of the account holder changes negatively after the authorization.

Therefore Saferpay claims the money directly, once the Capture of the transaction has been successfully executed. If the money cannot be claimed, the capture then returns an error. We generally recommend to execute the Capture as soon as possible, to avoid any issues.

PayPal iFrame integration

Warning: PayPal does not support the iFrame Integration!

PayPal actively blocks the iFrame-Integration. In order to circumvent this issue, the Saferpay Payment Page will break out of the iFrame and display the PayPal website full-size, in order to make a payment possible. However, please keep in mind, that the ReturnUrls will also be displayed full-size!

Other special cases

PayPal does also require you to meet the following requirements:

- OrderId: PayPal requires the Payment => OrderId to be unique. Saferpay however does not limit the use of the OrderId in any way. If you use PayPal, you have to make sure, that your system submits unique OrderIds for every PayPal-transaction, otherwise you will get an error-message during the authorization.

- Refunds: Unlike normal transactions, PayPal refunds always have the status CAPTURED, thus executing the money right away.