Refunds via API

Saferpay generally offers a refund functionality from the start through the Saferpay Backoffice. However, if automated, or more integrated processes are needed, the JSON-API can be used to execute refunds from the merchants webshop, or ERP-system. This part of the guide covers the process of how to execute refunds through the Saferpay JSON-API, which can be performed in two ways.

Note: Not all payment methods to support a refund functionality. Especially online banking payment methods do not provide refund functionality due to how the money is processed. You can find a complete overview of the supported functionalities in the Payment Method Features Matrix

.Attention: The refund functionality is part of the Transaction Interface, which is only available for holders of a business license on the live system. For the eCommerce license, these features are not available and a refund has to be executed through the Backoffice. The test accounts have business activated by default for evaluation purposes.

Requirements

- a Saferpay Business License

- a valid login access with a username and password for the Saferpay Backoffice.

- one active Saferpay ecommerce terminal

- Saferpay terminal number (TerminalId parameter) and Saferpay customer number (CustomerId parameter).

- valid acceptance agreement for credit cards or other payment methods

- Secure Card Data Module (if refunds are performed using Aliases. Method 2)

Method 1: Referenced refunds

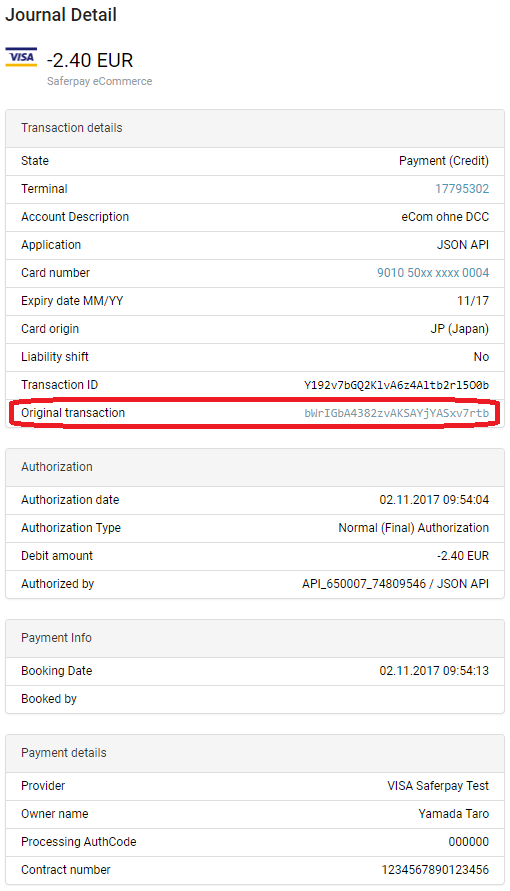

Referenced refunds are performed, by using the Refund request. This request accepts the CaptureId, of the transaction you want to refund!. By passing this ID through to Saferpay, the refund will be linked to the original transaction inside the Saferpay Backoffice:

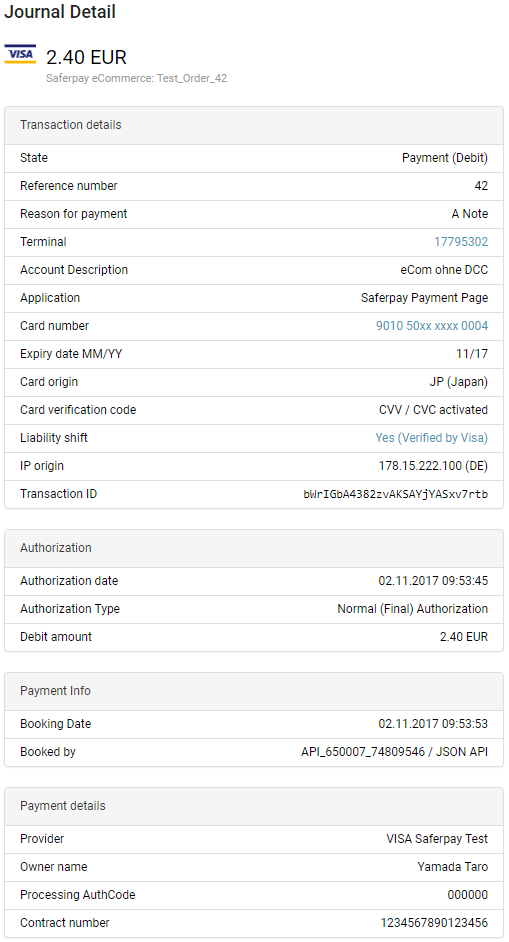

By clicking on the transaction ID you'll be redirected to the original transaction:

Try it out

You can try it out, by first doing a complete (including the Capture!) transaction, by using the PaymentPage, or Transaction Interface. The refund-option will be displayed, after the Capture has been executed!

Method 2: Refunds using an alias

A different method is using an alias obtained through Secure Card Data, which can be obtained in multiple ways.

This request is different from the that of the referenced refunds. When using an alias, the Refund Direct request has to be used.

Attention: While Refund Direct does offer the possibilities to submit the card number (PAN) directly, it is not allowed to do this without a full PCI-DSS certification. More on that topic can be found in theData Security and PCI DSS chapter.

Note: Due to the fact, that the original transaction ID is not submitted, like with referenced refunds, the refund will not be linked to the original transaction inside the Saferpay Backoffice!

.Try it out

Capture

Like normal transactions, refunds need to be captured/booked by executing the Capture request successfully, if the transaction STATUS is AUTHORIZED. The actual transfer of money will not be executed if the refund hasn't been captured!

Difference, between Cancel and Refund

It’s by no means rare that customers want to cancel their orders or return goods. As a merchant, you will in such a situation either want to cancel or make a refund for the transaction in question.

A cancel can be issued as long as the money-flow hasn't been initiated.

All Payment Methods, that go through the Daily Closing, can be cancelled this way, until the Daily Closing has been executed. Once that happened, the money flow has been initated and the transaction can no longer be cancelled. In this case you need to issue a refund, to transfer the money back to the card holders bank account! So a cancel actually stops the money transfer from happening, while a refund reverses the transfer, once it happened!

Please note, that there are exceptions. Some payment methods initiate the money flow with the capture. See: Special Cases Some methods downright do not support this behaviour, like all online banking methods, because those transfer the money right away and also do not offer the refund-functionality.

An overview can be found in the Payment Method Features chapter.

Additional information

Refunds are basically normal transactions where instead of debiting the cardholders account, you are crediting it. That means, that refunds go through the same authorization-steps like a normal (debit) authorization. Please keep in mind that a refund can also be rejected.

The refund amount value can differ from the originally authorized (debited) amount. This also applies to referenced refunds. The refund will be regarded as a completely new transaction, with its own set of parameters, like the amount value. So, if you want to refund two transactions in one batch, you can do that by simply adding the amounts together. It is also possible to do multiple refunds on one transaction, even though the originally authorized amount has been exceeded! Please make sure to keep track of this process.

One way to do so (like with normal transactions) is to submit the parameter "OrderId" inside the "Refund" container. This ID will be forwarded by Saferpay and will show up inside the Saferpay Backoffice (as the Reference number) as well as in your reconciliation-files.